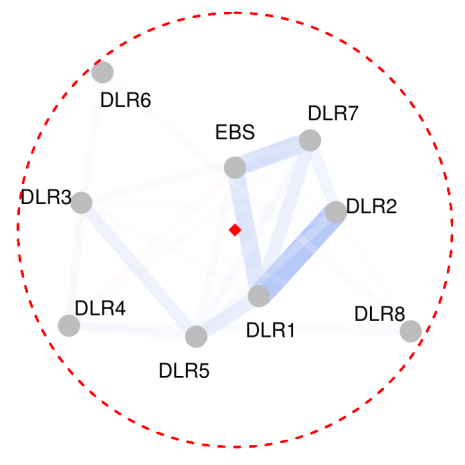

It is common in financial markets that the same or closely related securities are traded simultaneously in different markets. For example, the stocks of the Swedish firm H&M has its primary listing at Nasdaq Nordic, but its shares can be traded also at numerous alternative platforms, including multilateral trading facilities, dark pools, and systematic internalisers. The prices across all these venues are kept in sync by arbitrage, but how information is spreading across the venues is relatively unknown. In a recent paper published in the Journal of Finance, Björn Hagströmer (SBS) and Albert Menkveld (VU Amsterdam) develop a tool to map how information is linked in a network of venues that trade the same security.

Another area where financial networks are used is to map the cross-dependency in returns of different securities. Abalfazl Zareei (SBS) studies the impact of idiosyncratic shocks on portfolio risk in the presence of shock propagation mechanisms. An interdependency network is constructed with assets as nodes and links corresponding to cross-dependency in returns. By examining the propagation of shocks in this network, he shows that higher heterogeneity in the structure of the network increases portfolio risk. In another study, he tracks the propagation of idiosyncratic shocks in the financial market and shows that it can yield significant alphas.

Publications

Hagströmer, B. and A. J. Menkveld (2019). Information Revelation in Decentralized Markets. Forthcoming in Journal of Finance. https://onlinelibrary.wiley.com/doi/abs/10.1111/jofi.12838

Zareei, A. (2019). Network origins of portfolio risk. Forthcoming in Journal of Banking and Finance. https://www.sciencedirect.com/science/article/pii/S0378426619302389

Peralta, G., & Zareei, A. (2016). A network approach to portfolio selection. Journal of Empirical Finance 38A, 157-180. https://www.sciencedirect.com/science/article/abs/pii/S0927539816300603

Working papers

Zareei, A. (2019). Cross-Momentum: Tracking Idiosyncratic Shocks.